Making Your Vision Become A Reality

Don’t miss a single detail – download our moving CHECKLIST today!

Boost Your Productivity with Our Free Tools!

Our Most Visited Articles

10 Affordable Truck Rentals with 5th Wheel Hitches

Truck rentals with 5th wheel hitches can be a convenient and cost-effective solution for those who need to tow heavy loads on a short-term basis. Whether you’re moving large items…

How To Find Affordable Apartments In Tuscaloosa?

Are you moving to Tuscaloosa, Alabama, and looking for an affordable apartment? Finding a place to live can be a daunting task, especially when trying to stick to a budget….

Do Rental Trucks Have Hitches?

If you’re not sure, you’re not alone. Many people don’t know the answer to this question, but it’s an important one if you’re planning to rent a truck for your…

Are Trailer Hitch Adapters Safe?

Trailer hitch adapters are devices that are used to connect a trailer to a vehicle. They are designed to provide a secure and stable connection, ensuring that the trailer stays…

Penske Truck Rental At Home Depot

As many of you may already know, Home Depot offers a variety of truck rental options for both personal and professional use. One of the options available is Penske Truck…

Trailer Hitch Coupler Problems

Trailer hitch couplers are a vital component of any towing setup, as they connect the trailer to the tow vehicle. However, like any mechanical component, they can experience problems over…

How Much Does It Cost To Ship Suitcases

Shipping suitcases can cost anywhere from a few dollars to hundreds, depending on several factors such as the size and weight of the suitcase, the shipping destination, and the shipping…

How Much Does It Cost To Ship A Monitor

In today’s digital age, monitors are an essential part of our daily lives, whether we use them for work, entertainment, or both. However, when it comes to shipping a monitor,…

How Much Does It Cost To Ship A Candle

Candles are a popular item for many people and are used for a variety of reasons, from creating a cozy ambiance to using for aromatherapy. Shipping candles can be a…

How Much Does It Cost To Ship A Dog Internationally?

If you’re a pet owner and have to move to a different country, the thought of leaving your furry friend behind can be heart-wrenching. However, with the right information, you…

How Much Does It Cost To Ship To China

Shipping to China can come with its own set of challenges, but the cost doesn’t have to be one of them! With the right shipping method, you can ensure that…

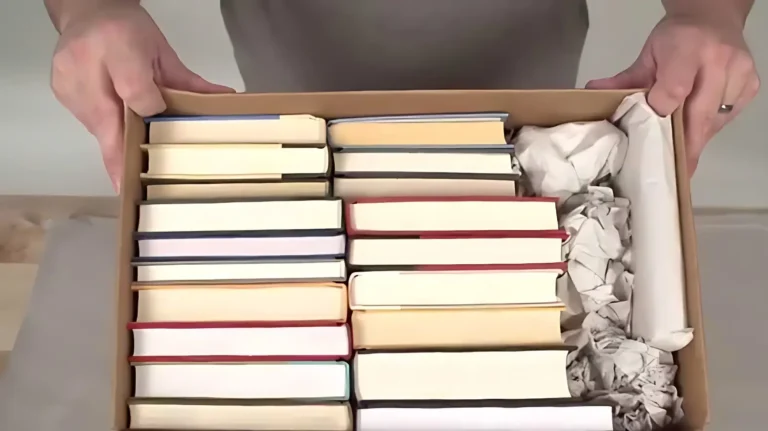

How Much Does It Cost To Ship Books?

Want to know how much it costs to ship books? Shipping books can be a bit tricky as the cost varies depending on various factors. Like the size and weight…

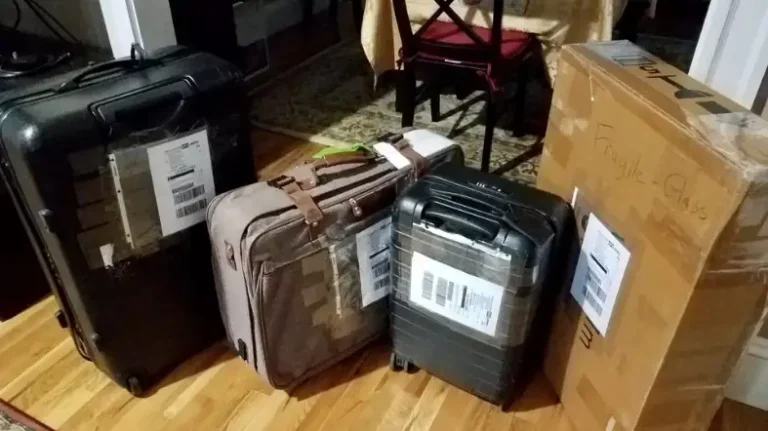

Cheapest Way To Ship Luggage Domestically In Usa

Say goodbye to baggage fees, long check-in lines, and struggling to carry your bags on and off transportation. Shipping your luggage domestically within the USA is a great alternative to…

Cheapest Way To Ship Framed Art

As an aficionado of the arts, are you on the lookout for the most cost-effective approach to dispatch your cherished framed artwork? Shipping artwork can be a formidable undertaking, particularly…

How Much Does It Cost To Ship A Laptop?

Are you looking to ship your laptop but unsure about the costs involved? When you decide to ship many fthing can influence the cost for example destination, shipping method, weight,…

Cheapest Way To Ship Boxes To Another State

Shipping boxes to another state can be expensive, but there are ways to save money. From comparing carrier rates to packing your boxes efficiently, we’ve got you covered. So read…

Best Way To Ship Vinyl Records

As a fellow audiophile, we acknowledge the significance of preserving the immaculate state of your vinyl collection. By practicing meticulous packaging methods and employing some expert insights, you can ensure…

Cheapest Way To Ship Clothes

Are you tired of spending a fortune on shipping clothes? We understand how frustrating it can be to pay a hefty shipping fee just to get your favorite outfit delivered….

Best Way To Ship Jewelry

When transporting jewelry, the security and preservation of these precious items are of paramount importance. It is imperative to safeguard your investment and ensure your clients receive their purchases in…

How Much Does It Cost To Ship A Mattress

Shipping a mattress might seem like a daunting task. To get your mattress from point A to point B, we’re here to assist you manage the fees and solutions that…

Cheapest Way To Ship A Shirt

Whether you’re a virtual vendor or simply in need of dispatching a shirt to an acquaintance or loved one, finding the most cost-effective shipment alternative is a high priority. Thankfully,…

Can Amazon Deliver To Mailbox

When it comes to online shopping, Amazon is a household name that many people rely on for their everyday needs. However, some customers may wonder if Amazon can deliver to…

Which Class Of Trailer Hitch Is Best Suited For A Boat?

There are a few different types of trailer hitches available on the market, and each has its own benefits and drawbacks. When choosing a hitch for towing a boat, it’s…

Jones Bigass Truck Rental And Storage

Are you in need of a reliable truck for your business or personal use? Look no further than Jones Bigass Truck Rental and Storage. With a wide range of trucks…

Does Amazon Deliver To Mexico

Are you living in Mexico and wondering if Amazon delivers to your doorstep? You’re not alone! With the rise of online shopping, more and more people are turning to Amazon…

West Orange Bike Trail Rental

West Orange Bike Trail Rental is located at West Orange Trails, a park in Florida. The company offers mountain and road bike rentals as well as a variety of accessories…

Does Amazon Deliver To Hotels

As a savvy traveler, you know that online shopping can save you time and money. But what happens when you’re on the go and need to have your Amazon purchases…

Usps Delivered To Wrong Address

We understand how it feels to know your packages were delivered to the wrong address. We’re here to help you resolve this issue with ease. But what happens when USPS…

How Long Do Ebay Take To Deliver?

Ebay is one of the most popular online marketplaces in the world, offering a vast selection of products for consumers to choose from. With its vast network of sellers and…

One Way Motorcycle Trailer Rental

Are you looking to rent a trailer to transport your motorcycle? In this blog post, we will discuss the convenience and benefits of renting a one way motorcycle trailer. Whether…

How To Respond To Being Left On Delivered?

Being left on “delivered” can be a frustrating experience, but it’s crucial to respond with tact and composure. Understanding that people have varying priorities and commitments can help maintain your…

What Brand Of Winch Is The Best?

Choosing the right brand of winch is a critical decision for all off-roading enthusiasts. When choosing, consider important factors such as weight capacity, cable type, durability, price, and customer support….

Do I Need A Winch Plate?

Are you an off-roading enthusiast looking to take your adventures to the next level? Do you enjoy pushing your vehicle to the limit and tackling challenging terrain? If so, you…

How Much Does It Cost To Ship A Rug?

Rugs are a popular home decor item that can add style and warmth to any room. However, shipping a rug can be a complex and expensive process. We will look…

What Time Does Usps Deliver To My Zip Code

If you’re expecting a package or important mail, you might be curious about when your mail carrier will arrive. The United States Postal Service (USPS) is a vital component of…

Does Usps Deliver To Door Or Mailbox

Are you tired of waiting for your package to arrive, only to find out it’s been left at the post office for pickup? Have you ever wondered whether USPS delivers…

Cheap Grocery Store In Tuscaloosa

We know that grocery shopping can be expensive, especially for families who are trying to stick to a budget. That’s why we’ve done the research and found the best places…

Who Buys Used Trailer Hitches?

Welcome to our blog about used trailer hitches! If you’re in the market for a trailer hitch, you may wonder who buys used ones and why. The truth is, a…

Do I Need a Sliding 5th Wheel Hitch?

Sliding fifth wheel hitches are very popular among RVers. They provide the advantage of being able to tow larger, heavier RVs easier and faster. But Do I Need a Sliding…

Can You Put A Hitch On A Honda Odyssey? Towing Made Easy!

Are you ready to hitch a ride on the Honda Odyssey express? Well, hold on tight because we’re about to take a wild ride through the world of automotive hitch…

Enclosed Motorcycle Trailer Rental

Are you planning a cross-country road trip with your motorcycle, but don’t want to ride the whole way? Or perhaps you need to transport your motorcycle for a move, but…

Free Truck Rental With Storage

If you need to move or transport large items, you know how expensive it can be to rent a truck. But what if we told you that you could get…

How To Rent A Truck From The Home Depot Truck Rental Center?

Do you need a truck for your next move or home improvement project? The Home Depot Truck Rental Center offers a convenient and affordable solution for renting trucks of various…

1-Day Truck Rental Unlimited Mileage

If you’re in need of a truck for a short period of time, but don’t want to be limited by mileage restrictions, then this is the perfect option for you….

Car Trailer Rental With Winch

If you need to transport a car or other vehicle but don’t have a way to load it onto a trailer, a trailer with a built-in winch can be a…

Cheapest Ways To Move Out Of State

Moving out of state can be a daunting task, especially when it comes to budgeting for the move. However, there are ways to save money and make the process as…

Best Motorcycle Hitch Carrier 1000 Lbs

Want to transport your thousands of pounds of motorcycle to the destination but can’t find the best motorcycle hitch carrier 1000 lbs? Relax! You are almost there. Following we’ve reviewed…

Category 1 Vs Category 2: 3 Point Hitch

Tractors of all sizes need a 3-point hitch to properly attach the many implements and accessories used for various jobs. That’s why there has always been a Category 1 vs…

Fire Truck Bounce House Rental

If you’re planning a birthday party for your child, or just looking for a fun and unique activity for a community event, a fire truck bounce house rental might be…

Top Companies That Rent Hand Truck Stair Climber Rental

If you’re in need of a hand truck for a one-time move or for ongoing use, you may be wondering where you can rent one. One option you might consider…

How To Adjust A Jost Fifth Wheel?

It is very important to make sure your Jost fifth wheel is adjusted properly to avoid any accidents or damage. A fifth wheel allows the trailer to move freely and…

20 Ft Flatbed Trailer Rental

Looking for a reliable and cost-effective way to transport your equipment or materials? Look no further than 20 ft flatbed trailer rental! With a variety of sizes and options available,…

Box Truck with Lift Gate Rental

A Box Truck with a Lift Gate can be a useful tool for transporting and handling heavy items, especially if you don’t have a warehouse or loading dock at your…

Bike Rack For Suv No Hitch

Looking for the best bike rack for SUV no hitch to carry your bike confidently and securely without using the hitch? Let’s get some! Below we’ve reviewed the top 10…

Best Bike Rental For Virginia Creeper Trail

The Virginia Creeper Trail is a popular destination for bike enthusiasts, offering scenic views and relatively easy terrain. If you’re planning a visit to the trail and need to rent…

3 Point Hitch Dimensions Diagram

The 3-point hitch comes in a number of distinct varieties. You can use them with several types of compact and subcompact tractors, lawnmowers, etc. So, to understand which type actually…

53 ft Reefer Trailer Rental

A 53 ft Reefer Trailer Rental is the perfect solution for businesses looking to store and transport food and goods efficiently and cost-effectively. With the latest in refrigeration technology and…

Tractor Supply Free Trailer Rental

If you need a trailer for your next project or outing, but don’t want to spend a fortune on rental fees, then you’re in the right place. Tractor Supply offers…

Pulling A Travel Trailer with a 1/2 Ton

Are you planning a road trip and considering pulling a travel trailer with a 1/2-ton vehicle? Towing a trailer can be a great way to extend the capabilities of your…

ATV Rentals and Trails in Illinois

ATV rentals and trails are a popular outdoor activity in Illinois, offering a thrilling and exciting way to explore the state’s natural beauty. Whether you’re a seasoned ATV rider or…